Latest online banking scam: How money is stolen through mobile OTP

1 / 11

Latest online banking scam: How money is stolen through mobile OTP

money

2 / 11

A Central Bank of India customer recently lost Rs 11.5 lakh in this scam

The scam came to light after a Delhi-based man complained about Rs 11.5 lakh withdrawn from his account without his knowledge. The victim had an account in Central Bank of India, Ashok Hotel, New Delhi.

3 / 11

The police found out about the thieves after scanning CCTV footage

After investigating bank officials, the police found out that the mobile number of the victim was changed and the crooks carried out transactions to withdraw and transfer money.

4 / 11

How the fraud takes place: By getting your personal data from sellers/hackers

Gangs first select their targets and based on that they retrieve data from third-party sellers. At times, they get in touch with hackers to extract personal data of prospective targets.

5 / 11

Personal data/information is targeted

The fraudsters want your personal data, most importantly your phone number. Hence, be careful about who you share your phone number with.

6 / 11

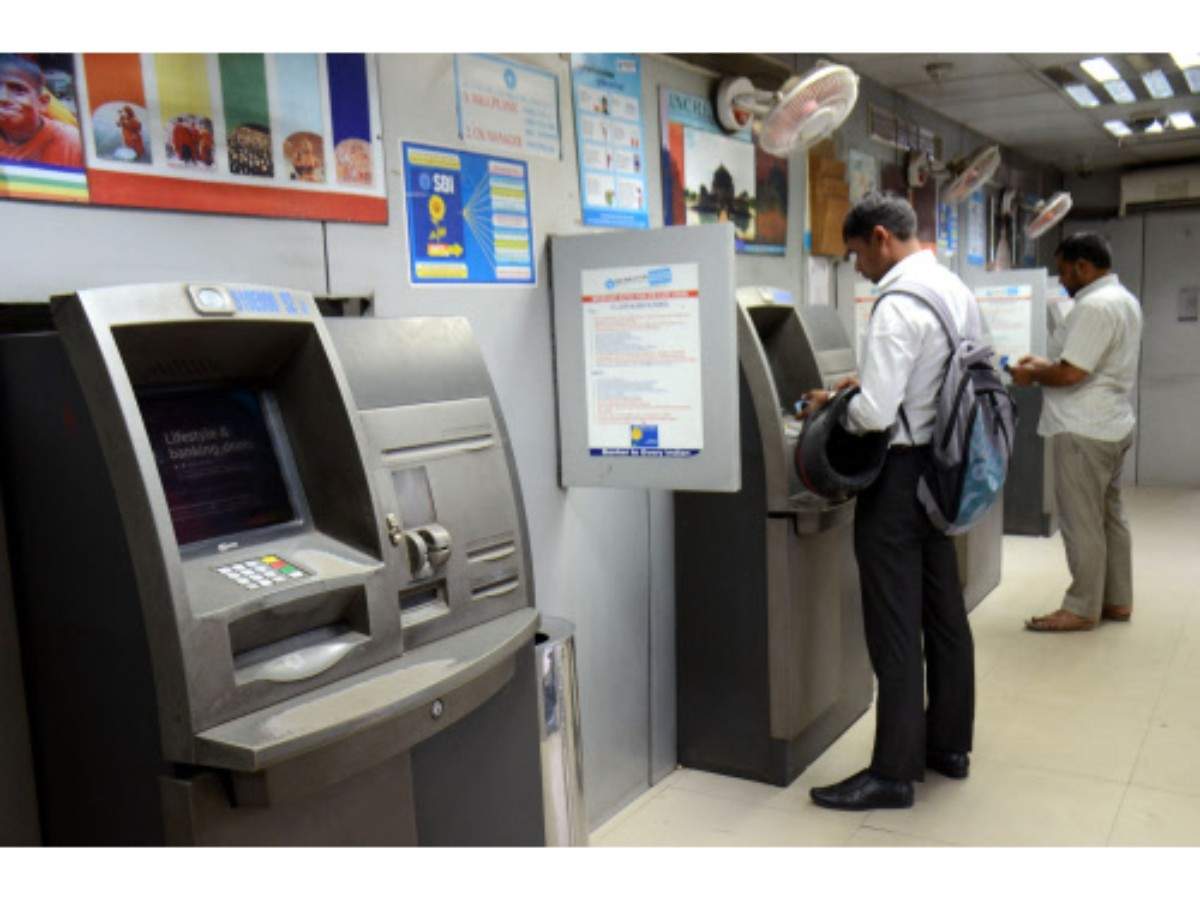

The next step is going into the bank

Armed with your personal information, the crooks then approach a bank. Once at the bank, they fill in a mobile number change request for the customer or customers they are targeting.

7 / 11

Bank officials may also be involved

What they do is without getting any proper verification, they change the customer’s mobile number. This can happen only if the bank officials are also involved in the fraud.

8 / 11

Once the mobile number is changed, OTP get sent on the ‘new’ number

With the new number, the gang of thieves start carrying out transactions. For all the transactions, you need an OTP or one-time password these days and this OTP now comes to the crooks and not you.

9 / 11

Using net banking, money is transferred from account

Most transactions are done through net banking as the OTP is needed for every single transaction. Money is transferred to various accounts and the targeted customer doesn’t even get to know.

10 / 11

Money is also withdrawn from victim's ATM and via cheque

With the mobile number being changed, it becomes easier to withdraw money from other sources like cheques and ATM.

11 / 11

How you can avoid such scams: Avoid sharing your number wherever you can

Be judicious about who you share your number with. While you might think that there’s no harm in giving out your number, it can easily be misused for such scams.

- Get link

- X

- Other Apps

Comments

Post a Comment